- Residential Moving

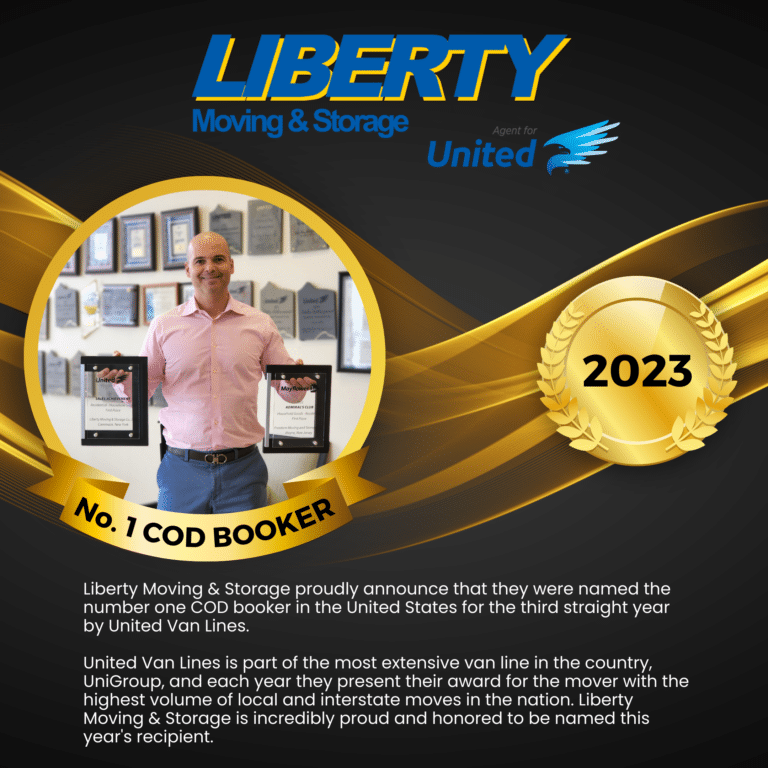

Liberty Moving has been providing dependable local moving services to our customers since 1939.

You may be moving far away, but your moving experience starts here.

Rely on Liberty Moving for efficient, full service overseas moves with full accountability.

We approach packing as a science and our residential packing specialists are some of the most highly skilled and trained.

Our flexible storage solutions give you the freedom to make smart and cost-effective decisions.

Make car shipping part of your complete moving package.

- Commercial Moving

- Storage Services

- Specialty Moving